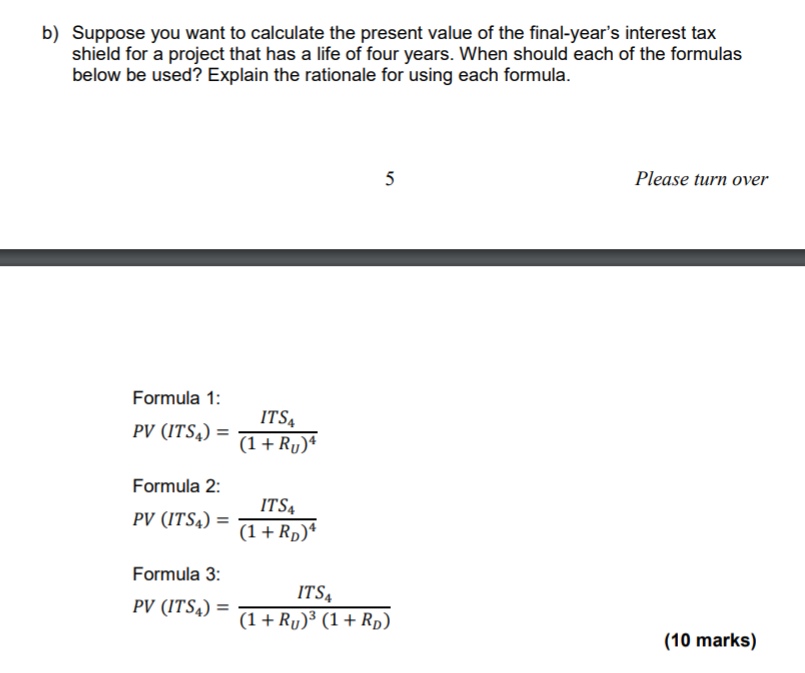

interest tax shield formula

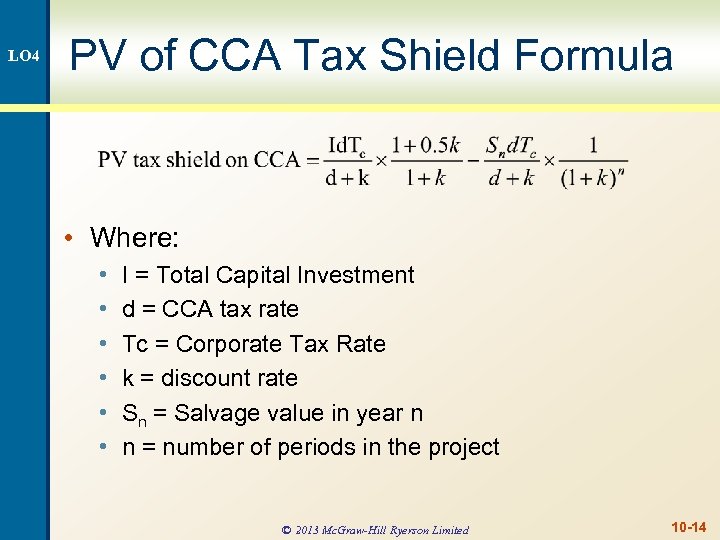

Tax Shield Deduction x Tax Rate. The term interest tax shield refers to the reduced income taxes brought about by deductions to taxable income from a companys interest expense.

When Does Capital Structure Matter Ppt Download

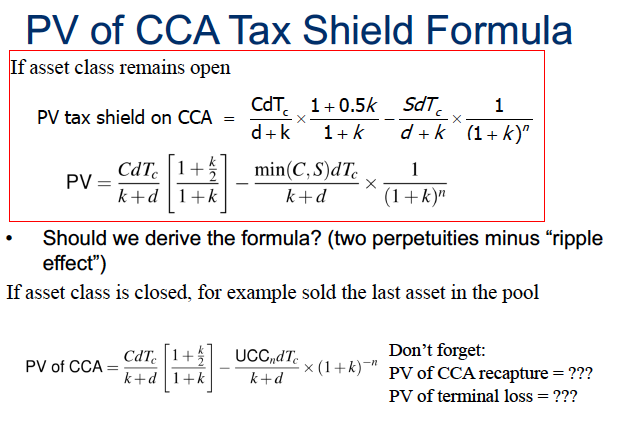

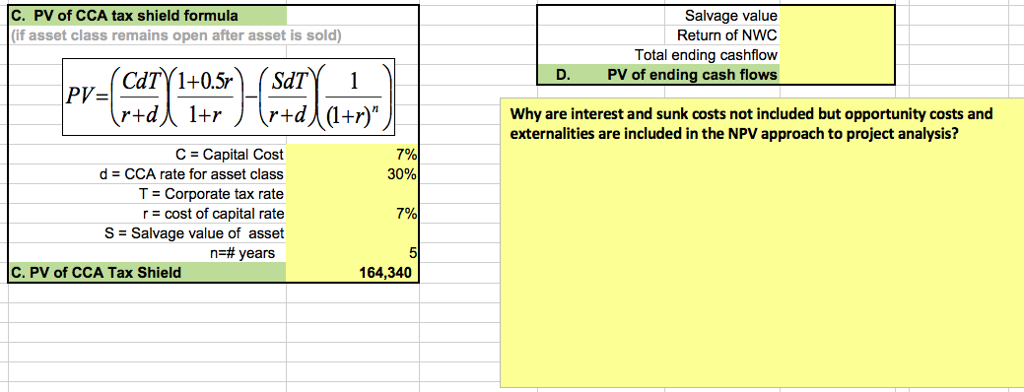

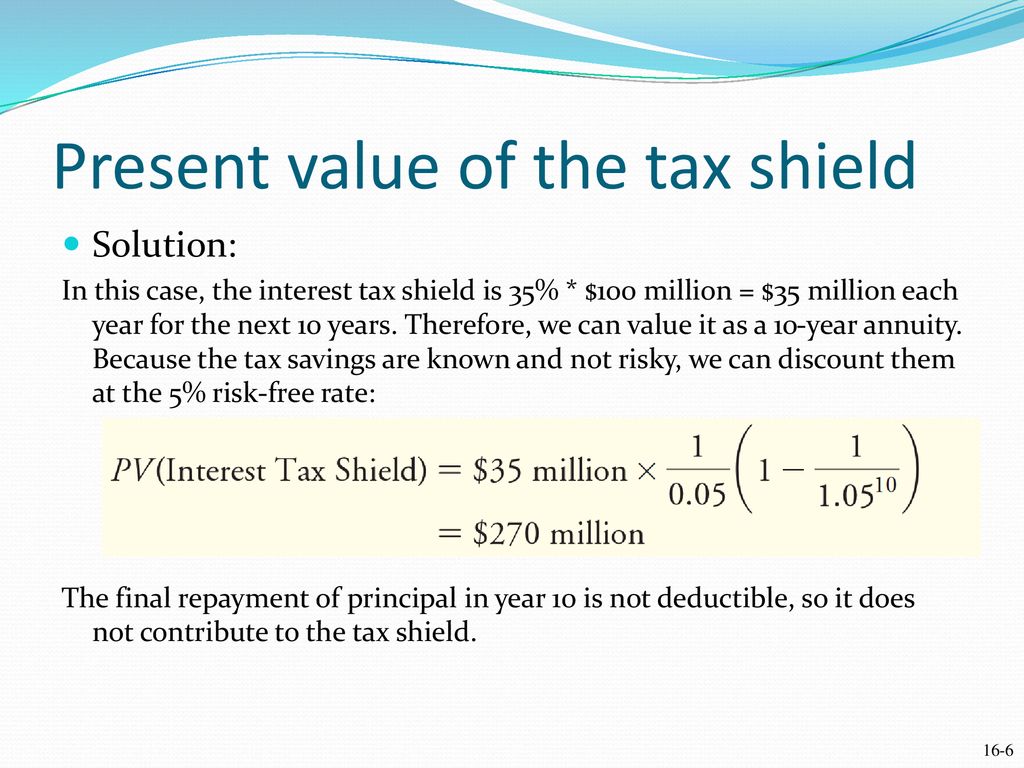

Calculate the projects net present value NPV considering the tax shield formula formula.

. The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give you. The value can be calculated by the interest expense multiplied by the companys tax rate.

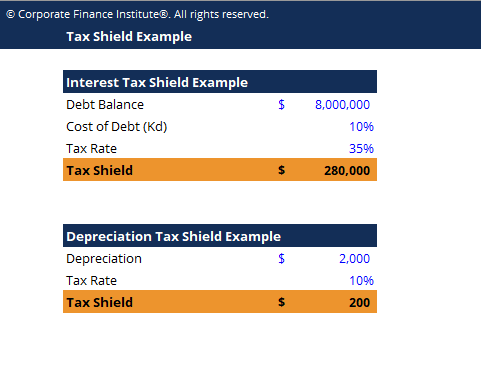

This is usually the deduction multiplied by the tax rate. In order to calculate the value of the interest tax shield you may. Interest Tax Shield Example A company carries a debt balance of 8000000 with a.

The effect of a tax shield can be determined using a formula. If you wish to calculate tax shield value manually you should use the formula below. Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate.

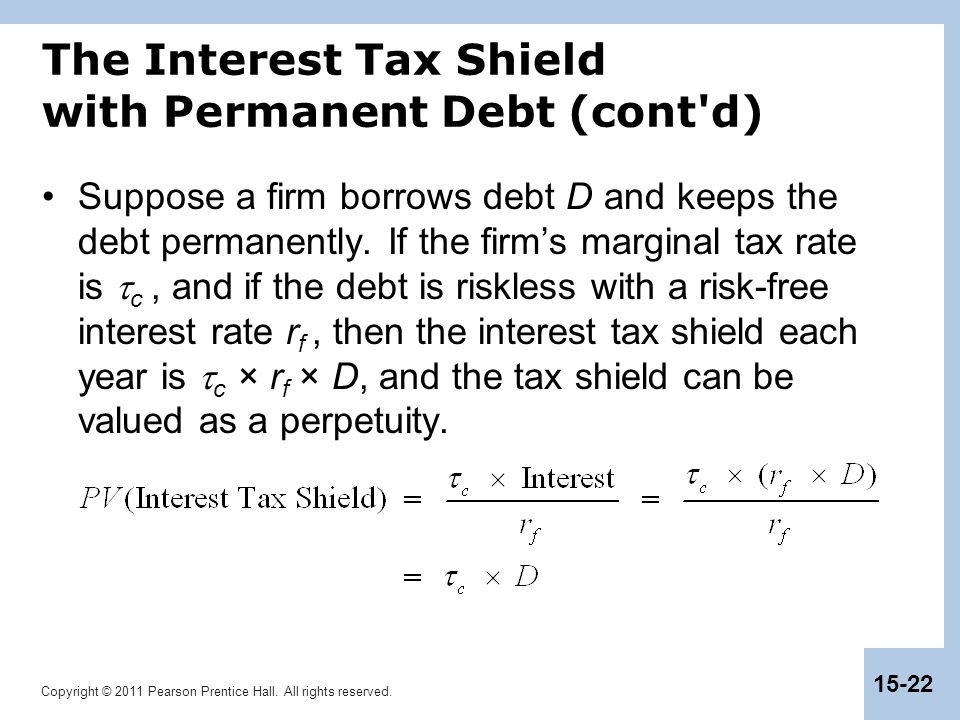

Interest Tax Shield Formula Average debt Cost of debt Tax rate. Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate FinanceESG. Calculating the tax shield can be simplified by using this formula.

Tax_shield Interest Tax_rate. Tax Shield Deduction x Tax Rate To learn more launch our free accounting and finance courses. The interest tax shield can be calculated by multiplying the interest amount by the tax rate.

Interest Tax Shield Interest expense Tax Rate Suppose company X owes 20m of taxes pays 5m. And this net effect is the loss of the tax shield. Adjusted Present Value - APV.

Due to the existence of tax-deductible expenses a tax advantage called tax shield arises. Tax Shield is calculated as Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate Tax Shield 5000 40000 10000 35. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage.

Tax on cash profit in 00000s Depreciation Allowances- Tax Rebate in 00000 Profit on sale of. Tax Shield formula Tax Shield Amount of tax-deductible expense x Tax rate For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax. For instance there are.

The aim of the chapter is to identify and define the well-known approaches associated. However adding back the protection is not straightforward because we need to consider the net effect of losing a tax shield. Interest Tax Shield Interest Expense x Tax Rate The APV approach allows us to see whether.

Depreciation Tax Shield Formula. To learn more launch.

Edit This Is All The Information Provided It Is Chegg Com

Berk Chapter 15 Debt And Taxes

Tough Outdoor Supplies Is Looking To Expand Its Chegg Com

Free Cash Flow To Firm Fcff Formula And Calculator

Interest And Tax Shield In Wacc Part 2 Youtube

Risky Tax Shields And Risky Debt An Exploratory Study

Interest Tax Shield Formula And Calculator

Solved B Suppose You Want To Calculate The Present Value Of Chegg Com

Chapter 10 Making Capital Investment Decisions Prepared By

Using Apv A Better Tool For Valuing Operations

Depreciation Tax Shield Formula Examples How To Calculate

Tax Shield Example Template Download Free Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Out Of The Perfect Capital Market Role Of Taxes Ppt Download

Solved Braxton Enterprises Currently Has Debt Outstanding Of 30 Million And An Interest Rate Of 6 Braxton Plans To Reduce Its Debt By Repaying Course Hero

Chapter 15 Debt And Taxes Ppt Download

V3220 Interest Tax Shield Samarth Safety

Solution Pelamed Pharmaceuticals Ebit Interest Expense Studypool